Save on Taxes! We All Could Use a Few Extra Dollars.

Did you know? Older taxpayers withdrawing their annual traditional IRA’s Required Minimum Distributions (RMD) can use a portion of those withdrawals to donate directly to the Hawthorne Community Association and not pay ordinary income tax on the amount of that withdrawal. What a great way to give to your favorite charity and save on taxes.

Did you know? Older taxpayers withdrawing their annual traditional IRA’s Required Minimum Distributions (RMD) can use a portion of those withdrawals to donate directly to the Hawthorne Community Association and not pay ordinary income tax on the amount of that withdrawal. What a great way to give to your favorite charity and save on taxes.

Amazing! Normally any dollars withdrawn from traditional IRA’S are taxed as ordinary income. However, the qualified charitable distribution (QCD) rule allows traditional IRA (Not simple IRA’s or 401K’s) owners to give to a charity and avoid the corresponding ordinary income tax. The rule effectively reduces your income taxes by lowering your adjusted gross income (AGI).

The QCD allows these charitable contributions when you are 70 1/2. But you must actually be 70 1/2 when you give. Not that your turned 70 1/2 during that fiscal year. Also the charitable gift needs to be made within the corresponding fiscal year. To save on your 2022 taxes, the gift MUST be made by December 31, 2022.

Most importantly, the contribution MUST go directly from your account to the charity. You cannot receive the distribution first. Fortunately, you can easily arrange this with your financial institution or financial advisor, usually through a simple form.

Most importantly, the contribution MUST go directly from your account to the charity. You cannot receive the distribution first. Fortunately, you can easily arrange this with your financial institution or financial advisor, usually through a simple form.

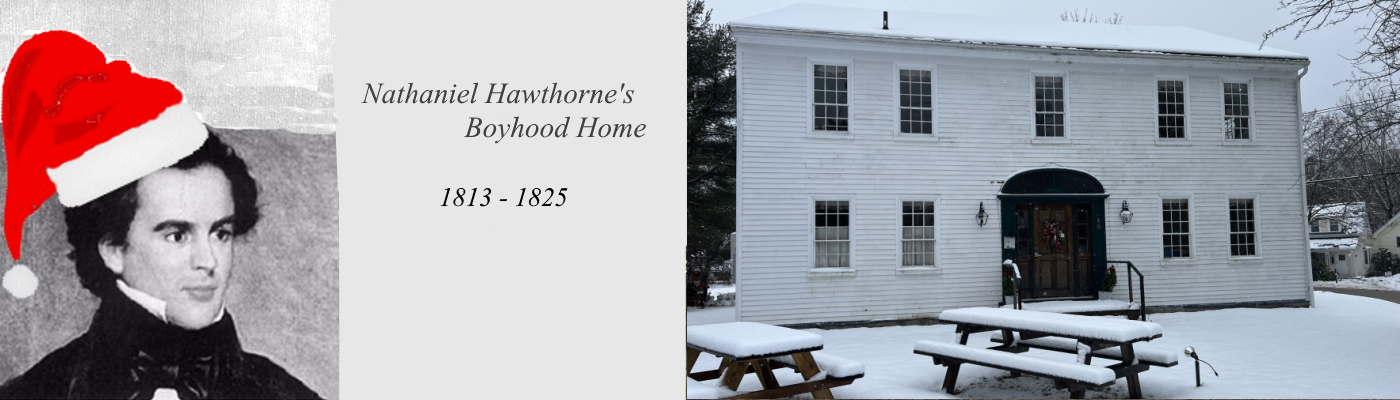

So please consider a Hawthorne House contribution from your RMD before that New Year’s Eve party!

IRS information can be found in IRS publication 590b.

https://www.irs.gov/publications/p590b

Also, below is a link to an excellent Wall Street Journal article entitled, ” When Donating to Charity From an IRA, Beware of These Tax Traps.”

It is a clear, well written article about important, subtle rules.

Follow the rules, go for the tax savings, and plese give to the Hawthorne House!